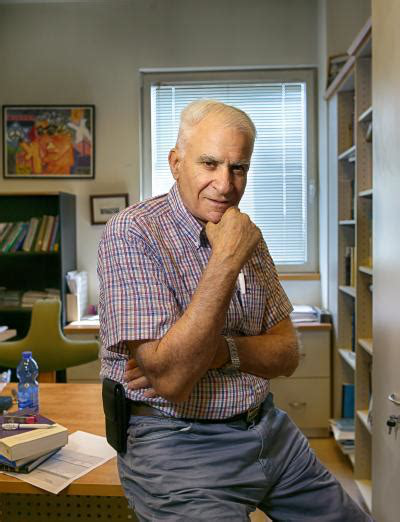

Assaf Razin

Country:

Israel

Company:

Economy

His father, Mordechai ("Mussia") Berezin was born during the beginning phase of World War I in Chisinäu. In the 1990s, Razin worked on the interaction between

capital and labor mobility, on the one hand, and tax and welfare systems, on the other. Razin did much of this work with Efraim Sadka, another colleague at Tel Aviv.

While the mobility of capital can be beneficial to countries, the desire to attract foreign capital by lowering taxes can lead to a "race to the bottom"; lower tax revenues can prevent governments from offering the public services their societies need.

The relevance of Razin's early work on this topic has come to the fore as coun

tries compete for foreign capital through tax breaks that deplete their finances, leading many to question how well foreign capital serves the generalgood.

Razin's work on the benefits and costs of capital flows made him a welcome vis-

itor to the IMF in the 1990s. After the 1994 Mexican "tequila crisis," ti was feared that other countries might be at risk.

In times past, economists had used simple rules to measure vulnerability, such as a current account deficit (a close cousin of the trade deficit) that exceeded 5-6 per-

cent of acountry's income. But with countries tapping into foreign capital, it seemed that they could run higher current account deficits as long they enjoyed the confidence of foreign investors.